FINANCIAL DISTRESS

Financial Distress

YES

Audit Outcome

QUALIFIED

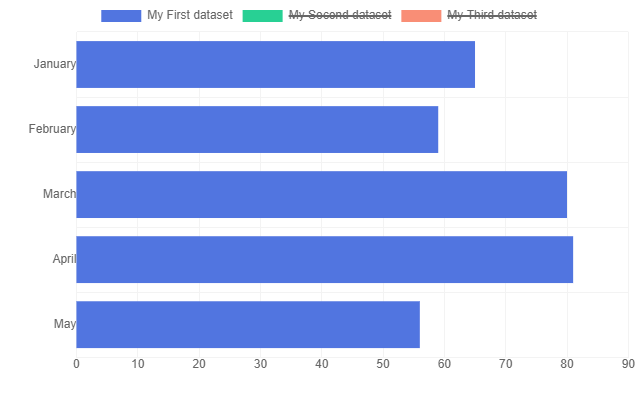

Score Summary

6

Ind 1 to 13

2

Ind 12 and 13

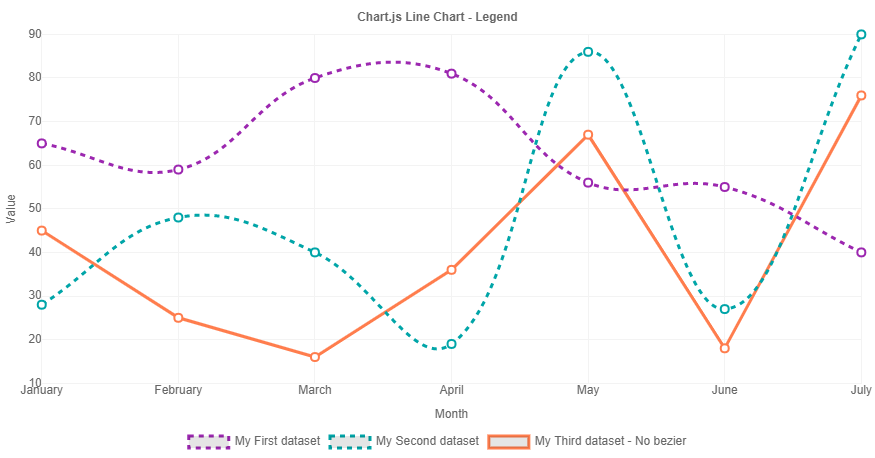

Financial Indicators

| 1. Cash/cash equivalent position | R 1 171 632 915 |

| 2. Cash plus investments less applications | R 792 652 551 |

| 3. Cash Coverage | 2.06 |

| 4. Repairs and maintenance expenditure level | 1.79% |

| 5. Asset renewal/ rehabilitation expenditure level | 32.76% |

| 6. Asset renewal/ Depreciation level | 44.47% |

| 7. Total CAPEX as Percentage of Total Expenditure | 20.45% |

| 8. Liquidity Ratio | 0.68 |

| 9. Debtors Days | 86.31 |

| 10. Creditors Days | 81.09 |

| 11. Debt (Total Borrowing) vs Total Operating Revenue | 5.62% |

| 12. Current Ratio | 1.61 |

| 13. Solvency Ratio | 8.76 |

BUDGET

Tabled Budget

FUNDED

Adopted Budget

UNFUNDED

Adjusted Budget

N/A

Funded Plan Available

Plan Approval (NT/PT)

Cashflow includes Surplus

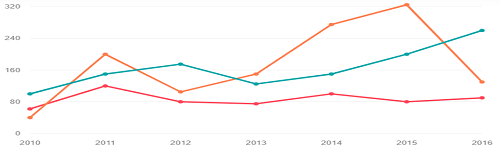

5 Years Budget Trend

DEBTS TO SUPPLIERS

Eskom

Total Due

R 260 307

Section 41

R 225 789

Section 71

R 34 518

Variance

R 207 931

Overdue

| Sales | R 471 860 |

| Payment | R 392 662 |

| NMD | R 0 |

| Total Interest | R 1 722 |

Trend Analysis

Waterboards

Total Due

R 160 789

Section 41

R 150 789

Section 71

R 10 000

Variance

Total Due by Months

Others

PAYE deductions

R 471 861

VAT

R 392 663

Pensions/Retirement

R 0

Loan repayments

R 1 722

Trade Creditors

R 471 861

Auditor-General

R 392 663

Other

R 0

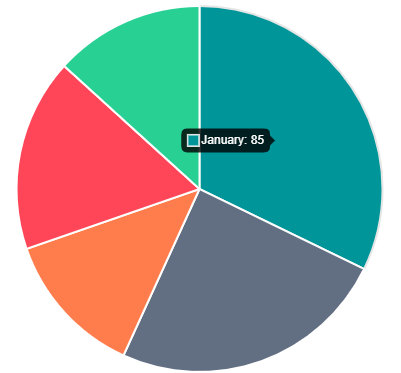

CUSTOMER GROUP DEBTORS

R 1 220 143 171

Organs of State

R 8 544 270 796

Commercial

R 10 852 105 785

Households

R 19 432 894

Other

Total Due